After seven weeks of staying at home, everybody is figuring out ways to make life feel a bit more normal again. Door Dash is on the go delivering food from local favorite restaurants. Church service is now streaming live with the ability to hit pause if the two-year old is acting up. With Zoom meetings all week long, working from home in t-shirts and shorts is not a bad way to get a lot accomplished. The kids are busy cyber learning in their online classrooms. Everybody is adapting to a new way of life. RCFE buyers are adapting as well and are looking to buy RCFE homes again. The market is waking up.

After reaching a low two weeks ago, Orange County had dropped to inherent, natural demand last seen during the start to the Great Recession. Yet, in the past couple of weeks a change was afoot. Reports from the real estate trenches of increased virtual showings and buyers writing offers again were repeated all over the county. Buyers are figuring out that they can still safely purchase an RCFE home in the middle of California’s “stay at home” order.

The real estate industry has adapted to selling homes in this new COVID-19 environment. Buyers view properties virtually via FaceTime, Facebook Live, Zoom, and virtual walkthroughs. Everything is done electronically, from providing a list of properties to sharing a comparative market analysis to signing documents. As a result, it is not surprising that general housing demand (the number of pending sales over the prior 30-days) increased by 9% in the past two weeks.

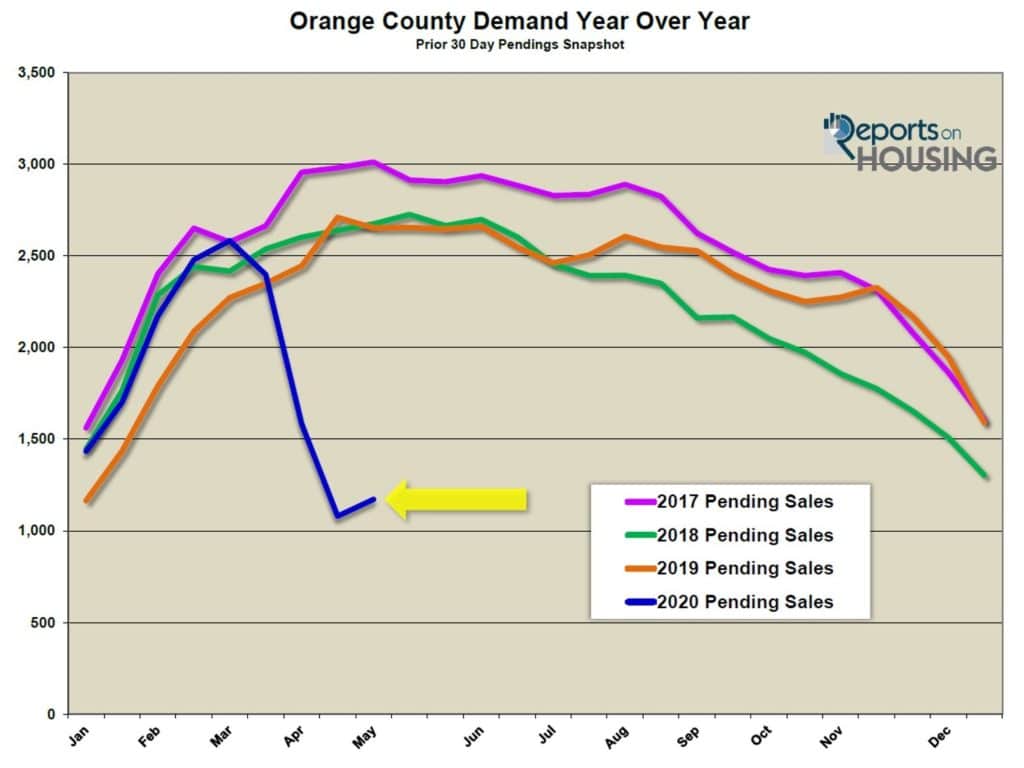

The chart below represents the demand year over year for ALL Orange County residential housing:

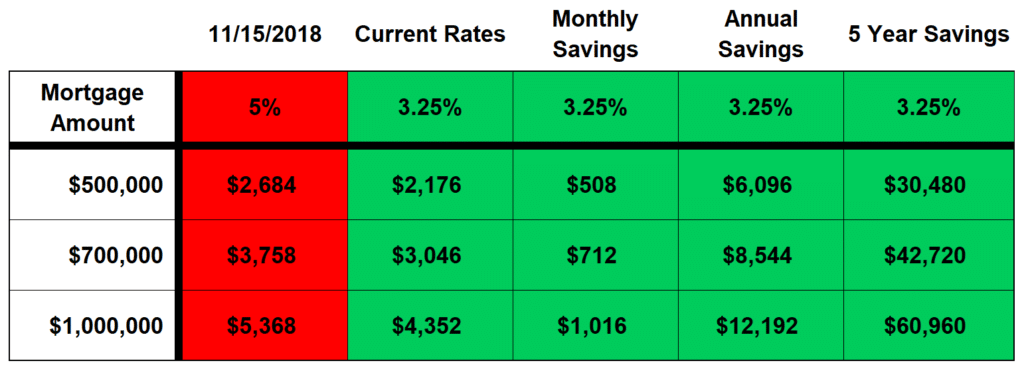

It appears as if the shock of COVID-19 and its impact on housing demand bottomed two weeks ago and is now on the rise. Expect demand to continue to rise going forward, especially with the added inventive of record low mortgage rates. In fact, they reached an all-time low last week, dropping to an average of 3.25% across the country. With lower rates, RCFE homes become much more affordable.

For example, in looking at a $700,000 mortgage, the monthly payment at 3.25% is $3,046 per month. That is a $712 per month savings, or $8,544 per year, compared to where rates were in November 2018, just a year-and-a-half ago. The savings are staggering, which helps explain why demand is starting to rise. It is hard to ignore the impact on affordability as rates hit these unprecedented levels.

Even with the large increase in demand for housing over the past couple of weeks, demand is still muted. Its current level was last seen in January 2018, a snapshot of what happens to the velocity of pending sales when interest rates rose to 5%. Demand for residential housing is off by 56% compared to last year. The demand for RCFEs is also considerably lower, a shadow of what it was a mere 3 months ago. So, COVID-19 is absolutely suppressing demand. But we stress, THERE IS STILL AN ACTIVE MARKET FOR RCFEs, although transactions are conducted, for the most part, virtually.

Stay tuned for future updates. At RCFE Resource Group, our team is committed to bringing you the most up-to-the-minute information about the housing market in general, and the RCFE market in particular. The biggest asset of your RCFE is, of course, the residence. RCFE homes, like any other homes, are subject to the same market forces that drive supply and demand.

If you are considering buying or selling an RCFE, please give us a call TODAY to schedule your complimentary video consultation. YOU ABSOLUTELY CAN BUY AND SELL AN RCFE VIRTUALLY! We have methods of conducting business in this new environment so that you will feel comfortable with your decision every step of the way. Michelle is also a CPA; Melvyn is a former mortgage banker. Together, we have the most accurate pricing tools to determine the fair market value of your RCFE home and business and to verify the accuracy of the price for any RCFE you are thinking of acquiring.

Please feel free to contact us with any questions or concerns. We welcome your comments and suggestions! If you have ideas for future articles, we would be delighted to hear them.

Until next time, we bid you well. Stay safe!