|

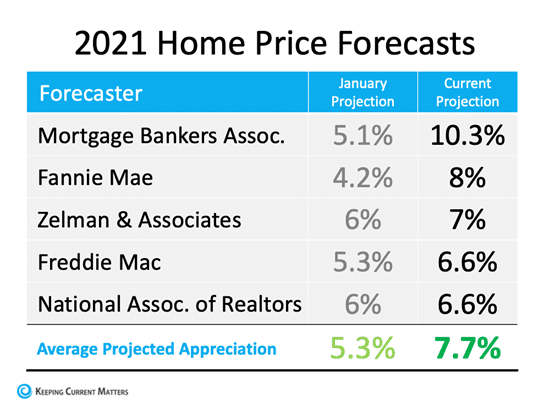

At the beginning of the year, industry forecasts called for home price appreciation to slow to about half of the double-digit increase we saw last year. The same is true of RCFE homes. The thinking was that inventory would increase from record-low levels and put an end to the bidding wars that have driven home prices up over the past twelve months. However, that increase in inventory has yet to materialize. The National Association of Realtors (NAR) reports that there are 30% fewer single-family homes available for sale than there were at this time last year. The same is also true for RCFE homes. This has forced those who made appreciation forecasts this past January to amend those projections. The Mortgage Bankers Association, Fannie Mae, Freddie Mac, the National Association of Realtors and Zelman & Associates have all adjusted their numbers upward after reviewing first quarter housing data. Here are their original forecasts and their newly updated projections:

|

Even with the increases, the updated projections still don’t reach the above 10% appreciation levels of 2020. However, a jump in the average projection from 5.3% to 7.7% after just one quarter is substantial. Demand will remain strong, so future appreciation will be determined by how quickly listing inventory makes its way to the market.

Bottom Line

Entering 2021, there was some speculation that we might see price appreciation slow dramatically this year. Today, experts believe that won’t be the case. RCFE home values will remain strong throughout the year.

If you are considering buying, selling or leasing an RCFE, please call us TODAY to explore your options. We would be delighted to evaluate your business and provide price guidance. We will help you obtain the highest possible price for your RCFE.

Michelle (949) 397- 4506 & Melvyn (949) 500-3630