New Trends Emerge

As rates zoom upwards, home affordability is beginning to impact the housing market in several profound and meaningful ways.

The scent of orange tree blossoms is captivating. It is just the beginning of the slow metamorphosis from flower to fruit. After the flower blooms, it takes navel oranges seven to 12 months to mature. It is far from instant, but as the petals drop, it reveals a tiny, green fruit that will eventually become a juicy, ripe orange.

Similarly, the evolution of the housing market is far from instant. It does not change like a snap of the fingers. Higher rates are like the orange blossom, just the beginning of a slow metamorphosis from an insane, out-of-control housing market to a slower, more balanced, normal housing market. It takes time, but new trends are already emerging.

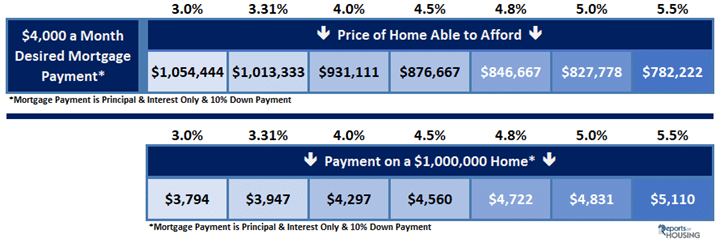

1. Rapidly rising rates mean affordability has taken a dramatic hit so far this year. According to the Mortgage Bankers Association®, interest rates have risen from 3.31% on December 29thto 4.8% on March 30th, representing a 45% increase. Mortgage rates for care homes are higher, depending on type of financing utilized. The purchasing power for buyers has rapidly eroded in such a short period of time. For a buyer looking to put 10% down and desiring a $4,000 per month payment, at the end of December they were looking at a $1,013,333 home. Today, that same buyer is now looking at homes just below $850,000. Another way of looking at it is how much more the payment is on a $1 million home. At 3.31% with 10% down, the payment would be $3,947 per month versus $4,772 per month at 4.8% today. That is an additional $884 per month, or $10,608 per year. Persistent higher rates will eventually diminish demand and, ultimately, throttle back the housing market. The pool of buyers able to purchase shrinks as rates rise.

2. Significantly fewer care homes are being placed on the market this year compared to the average prior to COVID. This includes RCFEs and ARFs. Originally, the extremely anemic inventory was preventing care homeowners from entering the fray. Today, it is more than that. Owners are more than happy keeping the status quo and putting their plans for expansion on hold. Difficulties in obtaining residents and the caregiver crisis have impacted many care homes. Owners are acutely aware that home values are continuing to rise, that mortgage rates have substantially climbed, and that the underlying mortgage loan on their refinanced care home is substantially lower than today’s 4.8% rate. Many RCFE and ARF homeowners who purchased several years back have refinanced to below 5.0% and have realized substantial appreciation. Yet in calculating their monthly mortgage payment and property taxes if they expand and purchase another care home, the monthly difference can be staggering. As a result, many care homeowners are opting to wait for the future to purchase additional care homes.

3. Demand, a snapshot of the number of new escrows over the prior month, has been substantially muted this year. Demand has been muted all year. A big reason for muted demand readings is the acute lack of care homes available to purchase. Simple economics: “You cannot buy what is not for sale.” True demand, the number of buyers in the marketplace, is considerably higher than tracked demand based upon escrow activity, yet is impossible to gauge other than home showing activity and the number of offers generated on homes today. Anecdotally, reports from the real estate trenches detail a reduction in the number of multiple offers real estate agents are receiving. Over time, if mortgage rates persist at these higher levels with duration, then demand will continue to remain muted compared to prior years even with more homes coming on the market. It is important to note that the strongest demographic patch of first-time home care homebuyers ever, millennials, is making its way through the real estate market right now. The surge of prime first-time care home buyers aged 32 years old occurs between 2020 and 2024. That demographic was added on top of an increase in buyer activity during COVID thanks to record low mortgage rates. Those record rates are gone, but there are still an astonishing number of millennials contributing to demand.

Yet, with mortgage rates climbing from 3.31% at the end of December to 4.8% today for typical residential homes, higher for care homes, new trends have emerged that will ultimately lead to a market downshift as long as higher rates endure.

Let our RCFE Resource team of professionals bring proven expertise to help you get the highest sales price for your RCFE or ARF!

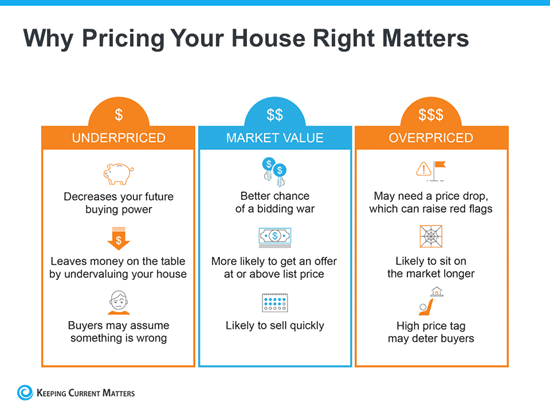

Lean on a Professional’s Expertise To Price Your House Right

There are several factors that go into pricing your RCFE home and balancing them is the key. That’s why it’s important to lean on an expert when you’re ready to sell. Our RCFE Resource team is knowledgeable about:

- The value of care homes in your neighborhood

- The current demand for RCFEs in today’s market

- The condition of your house and how it affects the value

We will balance these factors to make sure the price of your house makes the best first impression and gives you the greatest return on your investment in the end.

Bottom Line

Even in a sellers’ market, pricing your house right is critical. Don’t rely on guesswork. Call us TODAY for your FREE, No Obligation consultation and valuation to make sure your RCFE home and business are perfectly priced.

Let our RCFE Resource team of professionals bring proven expertise to help you get the highest sales price for your RCFE or ARF!