Fierce demand, throngs of buyer tours, bidding wars, rapid appreciation, and limited available RCFE homes to purchase are all due to historically low rates.

Insatiable Demand With a record low supply of RCFE homes available to purchase and staggering demand, the market is extremely hot.

In heading to Baskin Robbins on the 31st of any month with 31 days, there are lines out the door. Normally a scoop of ice cream is $2.79, but not on the 31st. On those seven days of the year, a scoop drops to $1.70, a 40% savings. For a large family with a bunch of kids, this is the day to make the pilgrimage to Baskin Robbins. And that is precisely what families do. As a result, there are long lines, and a long wait, to get that discounted scoop of deliciousness.

When a commodity drops to a price that is too good to pass up, everybody flocks to purchase. That is precisely what is occurring in housing. It is not that RCFE values have plunged by 40%; instead, it is historically low mortgage rates that are the catalyst to surging demand. As a result, RCFE buyers are coming out in droves to purchase. It is too good to pass up.

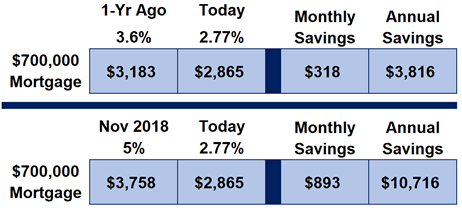

For RCFEs, the interest rate last year was typically higher than a single-family residence, approximately 6.0% for a monthly mortgage payment of $3,357. With today’s 5.25% rate, the payment drops to $3,092, a $265 per month savings, essentially a 7.9% discount. This saves about $95K over the life of the loan. Comparing today to November 2018 when rates nearly hit 7% to finance RCFEs, the savings jumps to $633 per month, a 17% savings. It is not a one-time savings either. This savings is every single month for 30-years.

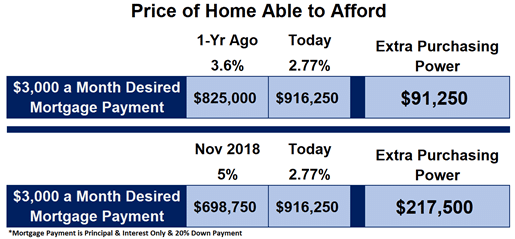

The following tables are for illustrative purposes only and depict the typical savings for a single-family residence. Interest rates are approximately 2.0-2.75% higher for RCFE mortgages than for single-family homes.

With record low mortgage rates, there is almost too much demand. It is like a pot of spaghetti that is boiling over. A quick fix would be to turn down the temperature. That is not that easy in housing. The only way to turn down the heat is for rates to rise. RCFE buyers may be rooting for an easier market with less competition, fewer competing offers, and a gentler rise in values, but that would come at the expense of higher rates and higher monthly payments.

It is the very thing that buyers are eager to take advantage of that is causing all their frustrations, record low mortgage rates. It seems that everyone wants to cash in on these incredible savings at the same time. At lower rates, RCFE homes become a lot more affordable, even for Southern California’s high dollar value housing stock. It improves a buyer’s purchasing power as well, allowing an RCFE operator on a budget to afford a lot more RCFE home.

Because of these low rates, demand is off the charts and everything that comes on the market is gobbled up almost immediately. With rock solid demand and an exceptionally low supply, the market is unbelievably hot and lines up heavily in the seller’s favor.

The bottom line: As rates climb, the market cools, RCFE homes take a lot longer to sell, and demand drops. The tradeoff is higher mortgage payments and a steep drop in a buyer’s purchasing power.

While today’s housing market may be boiling over on the backs of record low mortgage rates, RCFE buyers should keep the pedal to the metal and not give up. RCFE home values are on the rise and RCFE mortgage rates are slated to increase to the low-to-mid 6’s by year’s end. Waiting is quite simply not the answer.

If you are considering buying, selling or leasing an RCFE, please call us TODAY to explore your options. We would be delighted to evaluate your business and provide price guidance. We will help you obtain the highest possible price for your RCFE.

Michelle (949) 397- 4506 & Melvyn (949) 500-3630