The financial benefits of buying an RCFE home as compared to leasing one are always up for debate. However, one element of the equation is often ignored – the ability to build wealth as the RCFE homeowner.

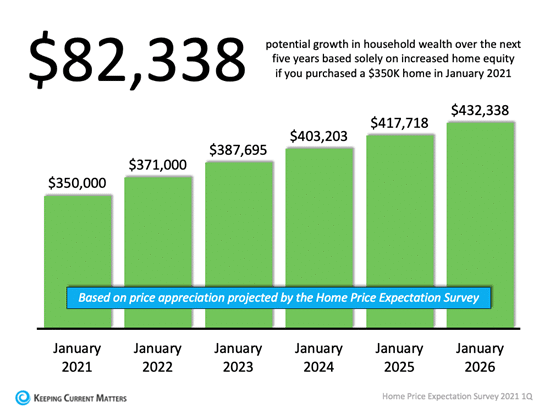

Most experts are calling for home prices to continue appreciating over the next several years. The most recent Home Price Expectation Survey, a survey of over one hundred economists, real estate experts, and investment and market strategists, expects home appreciation to increase in the U.S. as a whole as follows:

- 2021: 6%

- 2022: 4.5%

- 2023: 4%

- 2024: 3.6%

- 2025: 3.5%

Using their annual projections, the graph below shows the equity build-up a purchaser could earn, using a $350,000 home as an example:

An RCFE homeowner could increase their net worth by over $80,000 in five years. That’s an average of $16,000 annually. That number should be in any equation determining the financial benefits of owning an RCFE home compared to leasing.

If the average value of RCFE homes is in the $600,000s, an RCFE homeowner could increase their net worth by $141,151 in 5 years.

And if the average value is $850,000, the increase is almost $200K!

In California, the increase in net worth will likely be more sizeable, since anticipated appreciation rates are projected to be even higher for the Western region of the U.S.

Consider, also, the myriad tax benefits to owning real estate, and the overall financial benefits are yet greater.

Bottom Line

RCFE homeowners are going to make a substantial amount of money in home equity over the next five years. If you’re ready to buy an RCFE home, call us TODAY so you can enjoy this great benefit as well.

If you are considering buying, selling or leasing an RCFE, please call us TODAY to explore your options. We would be delighted to evaluate your business and provide price guidance. We will help you obtain the highest possible price for your RCFE.

Michelle (949) 397- 4506 & Melvyn (949) 500-3630